Is The Stock Market Open Jan 3 2022

Stock Market Open Good Friday 2022

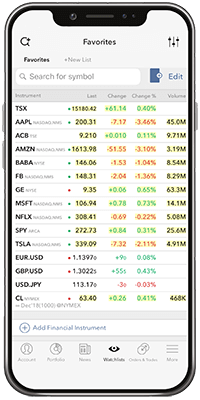

Webull is a mobile app-based brokerage that offers commission-free stocks, ETFs, and other trading options. The platform is designed for intermediate users, with advanced order types, advanced charting, and tons of stock market research data for users to develop personalized investment strategies. Weibull is also offers a notable trading simulator. It can help beginner traders who want to learn about active trading. The company even holds competitions with monetary prizes to encourage new traders to practice.

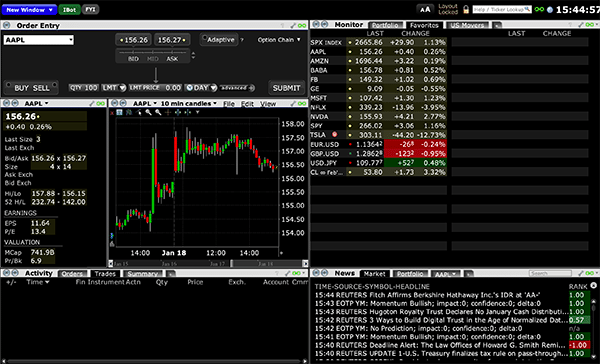

TD Ameritrade has long been a favorite of active traders, and the broker brings two trading platforms to the fight. Its classic web-based platform does all the core fundamentals, including streaming news, third-party research and watchlists. TD ups its game with its thinkorswim platform, which is available in web, desktop and mobile versions. This full-powered platform gives you access to not only the basic securities (stocks, bonds, ETFs, options and mutual funds) but also the more advanced ones (futures, forex and futures options). You’ll have some 400 technical studies and plenty of charting tools as well as analytics to help you understand it all.